In order to keep its customers regularly informed about the evolution of material prices, and in particular steel and stainless steel prices, Filame regularly questions its panel of suppliers to get their forecast on the evolution of prices over the next weeks and months.

As reported by Het Staaljournaal, the events in Ukraine have created chaos on the steel market. This was compounded by the problems with nickel on the LME, which led to a suspension of the nickel price. Trading did not resume until the end of last week. At the same time, these events also had a significant effect on the price of energy and therefore on the production prices of steel, stainless steel and aluminum, whose production requires large quantities of energy, even though the upward trend in energy had begun with the events in Ukraine. The aluminum market is also strongly impacted.

In this context, several steel mills are maintaining high prices and offering reduced tonnages for hedging purposes. Moreover, as some buyers, especially those who did not replenish their stocks in previous months after last year’s difficulties, are trying to obtain new stock for fear of running out later, there is an effect on demand that is also pushing prices up.

It is therefore difficult to predict with a reasonable degree of certainty the evolution of the price of steel and stainless steel materials and their availability. Prices are often set on a day-to-day basis according to availability and there is often no way to obtain commitments in this regard for periods longer than 24 hours.

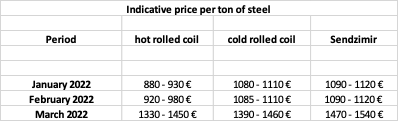

Filame’s supplier panel reports a price increase of € 410/430 per ton of steel. For spring steel wire the increases are about 450 €/ton.

As for stainless steel, although the alloy surcharge continued to rise in March, the effect of the nickel crisis on the LME has not yet been reflected in the price. We will have to wait for the indications for April and May, knowing that the price of extra alloy is set monthly. Nevertheless, the increase in the price of steel will already have an influence on the price of stainless steel, whose share of steel in the price represents between 40 and 50% of the total price.

In this context, Filame indicates that its price offers are subject to changes in the price of the material and that, depending on the date of the order compared to the date of the offer, Filame may have to adjust its prices according to the purchase price of the material at the day of its delivery.